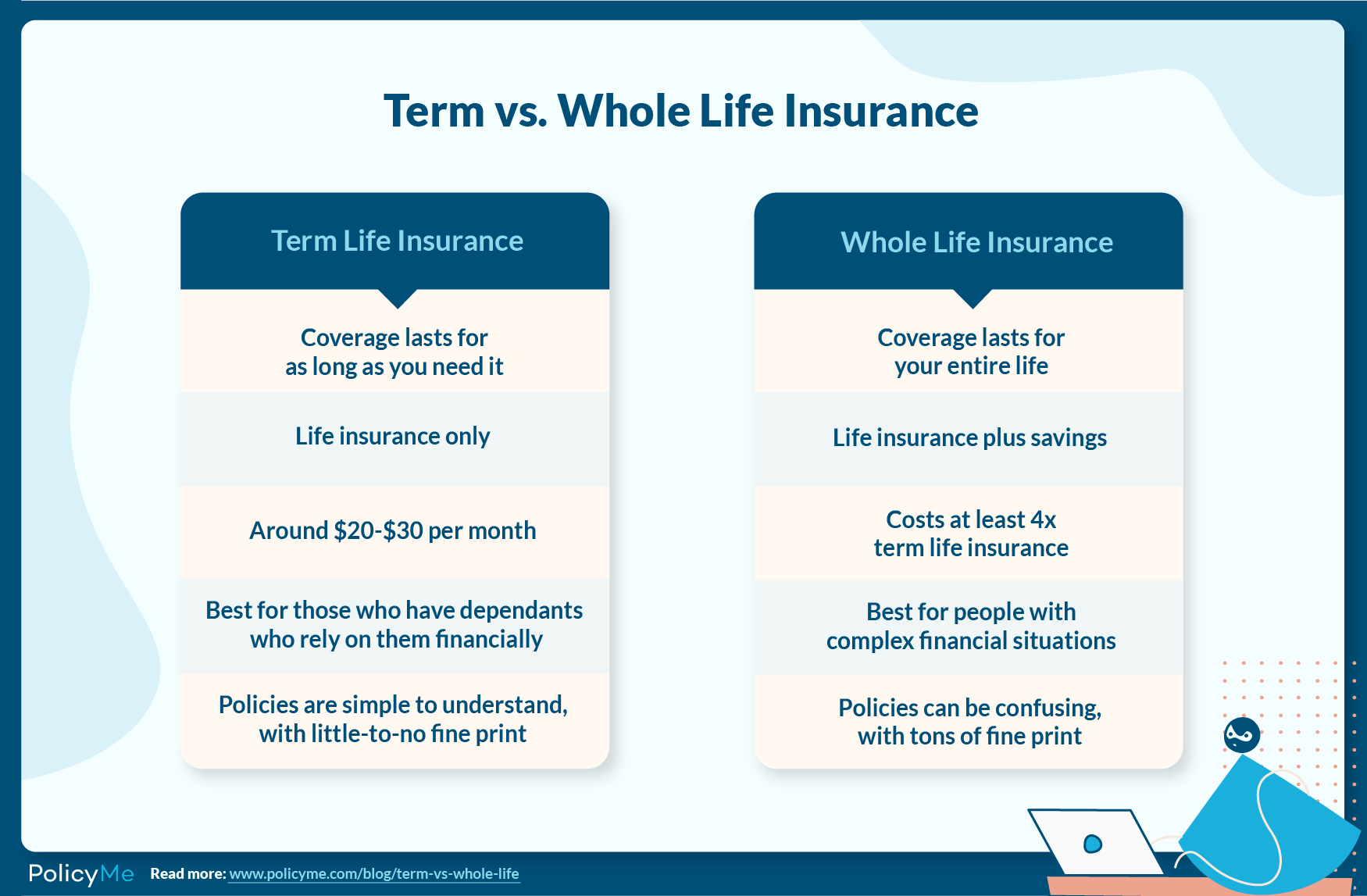

Term vs Whole Life Insurance When it comes to life protections, you’ll regularly discover yourself at a junction, having to select between term life protections and entire life protections.

These are the two most common sorts of life protections approaches, and each serves a diverse reason. To form the correct choice for you and your family, it’s pivotal to get it the key contrasts between the two.

Term Life Insurance:

Term life protections is regularly compared to leasing a security net for a particular period. You buy scope for a foreordained term, ordinarily 10, 20, or 30 a long time.

In case you pass absent amid this term, the approach pays out a passing advantage to your recipients. In any case, on the off chance that you outlast the approach, there’s no payout, and the scope closes. Here are a few critical perspectives to consider:

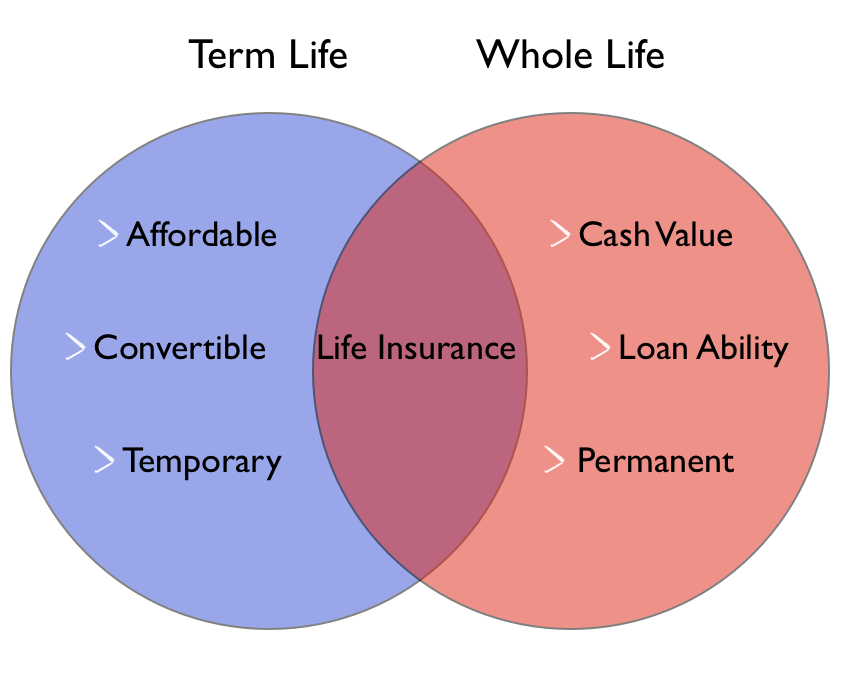

Reasonableness: Term life protections is more often than not more budget-friendly than entirety life protections, making it an alluring alternative for youthful families or people with restricted resources.

Transitory Needs: It’s an great choice in case you need to ensure your adored ones amid your working a long time, especially in the event that you have got money related obligations like contracts and college tuition.

No Cash Esteem: Term approaches don’t construct cash esteem or offer investment opportunities. It’s unadulterated insurance.

Recharging Costs: On the off chance that you would like scope past the introductory term, be arrange for essentially higher premiums upon recharging.

Whole Life Insurance:

Entire life protections, as the title recommends, covers you for your whole lifetime. It not as it were gives a passing advantage but too incorporates a cash esteem component. Here are a few key focuses to consider:

Long lasting Scope: Entire life protections gives peace of intellect, knowing your recipients will get a payout once you pass absent, in any case of when that happens.

Reserve funds and Speculation: A parcel of your premiums goes toward a cash esteem account, which grows over time. You’ll be able borrow against this cash esteem or indeed yield the approach for its cash value.

Higher Premiums: Whole life protections is more costly than term life protections, because it combines protections with a reserve funds component.

Ensured Benefits: It comes with ensured passing benefits and premium installments, giving budgetary soundness and consistency.

Choosing the Right Policy: When deciding between term and whole life insurance, it’s important to consider your individual needs, financial goals, and budget. Term life insurance may be suitable for individuals looking for affordable coverage for a specific period, such as until their children are grown or a mortgage is paid off. Whole life insurance, on the other hand, may be preferable for those seeking lifelong coverage with the added benefit of cash value accumulation.

- Cost Comparison: One of the primary factors to consider when choosing between term and whole life insurance is the cost. Term life insurance premiums are typically lower initially, making it more affordable for individuals on a tight budget or those looking for temporary coverage. Whole life insurance, on the other hand, has higher premiums due to its lifetime coverage and cash value component. It’s important to assess your budget and financial goals to determine which type of policy aligns best with your needs.

- Investment Component: Whole life insurance includes a cash value component that accumulates over time and can be accessed through policy loans or withdrawals. This cash value grows on a tax-deferred basis and can serve as a source of supplemental income or emergency funds. Some individuals view whole life insurance as a combination of insurance protection and long-term investment, while others prefer to separate insurance and investment components through term life insurance and other investment vehicles.

- Flexibility and Customization: Term life insurance offers flexibility in terms of coverage duration, allowing policyholders to choose a term that meets their specific needs and financial obligations. Whole life insurance provides lifelong coverage and offers policyholders the option to customize their coverage and premium payment schedule based on their preferences. Policyholders can also add riders to their whole life insurance policy to enhance coverage, such as accelerated death benefit riders or long-term care riders.

- Estate Planning and Legacy: Whole life insurance can play a valuable role in estate planning and wealth transfer by providing a tax-free death benefit to beneficiaries. It can help cover estate taxes, pay off debts, or provide an inheritance to heirs. Term life insurance may also be used for estate planning purposes, especially if temporary coverage is needed to protect assets or provide for dependents during specific life stages.

Conclusion Term vs Whole Life Insurance

In conclusion, Term vs Whole Life Insurance choosing between term and entirety life protections may be a choice that ought to be made after cautious thought of your money related goals, chance resistance, and by and large budgetary circumstance.

Counseling with a qualified protections specialist or financial advisor can give priceless experiences and assist you make an educated choice. In a few cases, Term vs Whole Life Insurance a combination of both term and entirety life protections may be the correct methodology to address distinctive budgetary needs and objectives.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial or insurance advice. Before purchasing a life insurance policy, it’s important to consult with a qualified insurance professional to discuss your specific needs and options.